Canadians are currently dealing with the highest inflation rate the country has experienced in decades. Prices across the country are climbing, except for one; cannabis. During inflation, the price of goods and services increase, while the quality remains the same. Cannabis has experienced the opposite as consumers are able to purchase the same or better-quality cannabis, while prices have been decreasing.

Retail cannabis prices are far from what was predicted by Deloitte in 2018. Deloitte reported that consumers would pay $8.98/gram for retail dried cannabis in a legal market. During the opening months of legalization, prices superseded the illicit market due to supply chain shortages and regulatory bottlenecks. By the end of 2019 cannabis products were in a surplus as licensing regulations eased up and Cannabis 2.0 products were hitting the shelves. The surplus drove strong pricing competition and consumers were able to buy more cannabis for less. Since legalization, prices of recreational dried cannabis flower have dropped 8.3%.

The market has also become increasingly value oriented since legalization. Due to heavy restrictions placed on cannabis marketing, price remains one of the main differentiators between products and the driver of consumer’s purchasing decisions. Cannabis in the value segment is at or slightly below the illicit market. Between October and December of 2021, 61% of sales of dried cannabis flower on the Ontario Cannabis Store (OCS) website were between $3 and $6.50 on a per gram basis.

Municipal bylaws placed on cannabis retailers have left many communities across Canada without access to a dispensary, while other areas are overcrowded with cannabis stores. There are more than 200 cannabis stores in Toronto alone, and as the area becomes saturated, independently owned stores are struggling to keep their doors open. Large and well funded dispensary chains across Canada are accepting low to no margin to gain market share, collect and monetize consumer information, and push out less capitalized independent operations. The combination of strong price competition and low margins has caused multiple stores to shut down, and it is predicted that more are to follow a similar fate.

The excise tax on dried cannabis flower currently stands at $1/gram or 10%, whichever is higher. This rate was determined based on pre-legalization market projections that legal cannabis would retail for $10/gram. In today’s market, the average revenue on dried cannabis flower is $3.99/gram, and $1 of this must go towards excise tax. The government has failed to update tax rates based on today’s low market prices, forcing license holders accept low to no margins. The unfortunate reality is license holders of all sizes are struggling to pay their bills.

Large players in the industry have announced facility closures in efforts cut costs and focus on higher performing assets. As a part of their cost savings plan, Aurora Cannabis closed its Aurora Sky facility in Edmonton in May 2022. In April 2022, Hexo Corp. announced that they will be closing their Breville facility as a part of a strategic plan to become cash flow positive. In March 2022, Cronos Group announced that they will be closing the doors to their Clearview Township plant, and in November 2021 Canopy Greenhouse Corp. shut down one of their largest greenhouses to cut costs amid their ongoing pursuit of profitability. Prices along the overall supply chain has been compressed and the retail sale price is the first indicator. As taxation has remained fixed it has been increasingly difficult for all segments of the industry to achieve healthy margins.

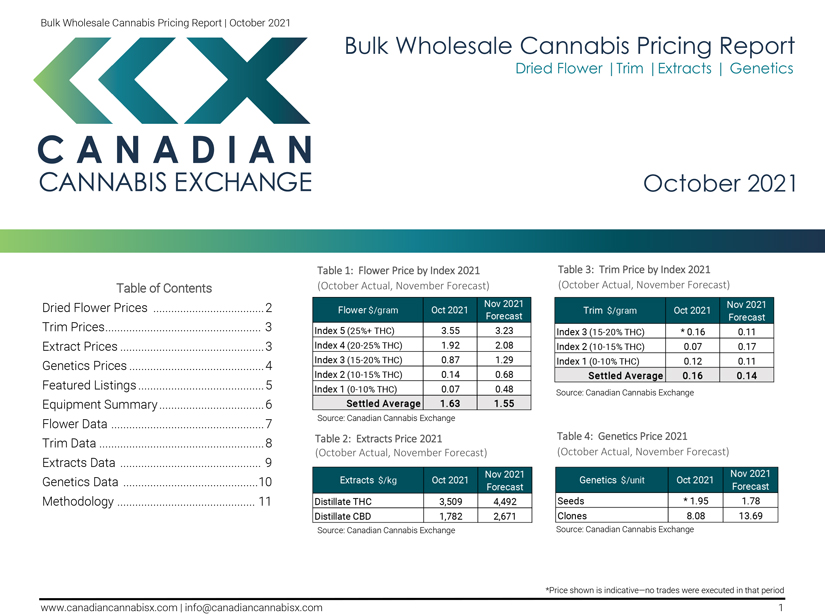

The B2B space has also seen price compression in wholesale dried cannabis flower prices. In April, the Canadian Cannabis Exchange (CCX) saw average settled flower prices all THC indices to be $1.71/gram. Multiple product categories have experienced downward pricing pressure as producers are competing on price in all sales channels. Changes are required to support the financial health of the legal cannabis industry if the provincial and federal governments are interested in a robust market serviced by producers and retailers of all sizes offering a unique product mix to consumers.

CCX is in support of the Grass on the Hill – the Cannabis Leaders Summit and Lobby , presented by the Cannabis Council of Canada. In the lead up to the Statutory Reviews of the Cannabis Act, this event is designed to provide the knowledge and tools to advocate for regulatory changes within the Cannabis Industry. Grass on the Hill takes place May 30 and 31 in Ottawa and we strongly encourage everyone to attend to voice their experiences, thoughts, and priorities regarding the changes in support of the financial viability of cannabis license holders.

From Canadian Underwriter