Typical consumer packaged goods companies encounter minimal fluctuation in month-to-month financial reporting, but businesses that rely on variable commodity pricing such as cannabis are a different story.

Cannabis companies are poised with the challenge of accurately valuing biological assets for government and corporate reporting. Using market representative data to capture the true value is important to accurately report the significant volatility cannabis experiences. While adjustments can be made monthly, achieving an accurate financial snapshot can be more complex. The Canadian Cannabis Exchange is a reliable source for spot and term data on all wholesale cannabis products.

In the developing Canadian cannabis market, there has been a lack of consistency in how cannabis is valued through its lifecycle. Based on the IFSR standard IAS 2, as soon as a plant is harvested it becomes inventory and should be measured at the lower of cost or net realisable value (NRV).

NRV is the estimated value for which an asset can be sold, minus the estimated costs of selling or discarding the asset. The calculation of NRV is critical as, if not completed with verifiable market data, it could lead to the over or under valuation of a company’s assets. Best practices in calculating NRV can include:

- Using a year end spot price and market forward price to provide a reliable estimate for realizable prices.

- A standard method, including a stable data source should be used and this approach should be consistent from one year to another.

- The net realisable value of inventory not expected to be sold for a long period of time will typically be low, as determined based on the discounted future cash flows.

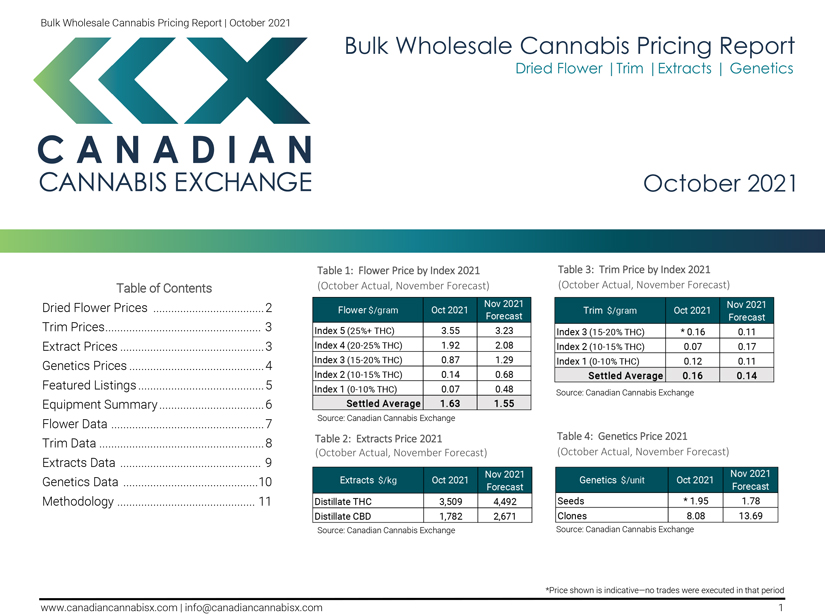

The process of determining market price can be a challenging prospect in a new sector such as cannabis. However, the Canadian Cannabis Exchange’s year end and monthly pricing data provides a reliable source for wholesale settled prices. Our settled prices are tracked by THC bands and are based on completed deals on our live transparent trading platform. The CCX Wholesale Cannabis Pricing report was based on over 700 trades providing the only liquid wholesale flower pricing in the sector.

Investors and executives need reliable market representative pricing to produce sound financial statements and make strategic investment and divestiture decisions.

For more information on our pricing data and methodology please reach out to client@canadiancannabisx.com